Builders Risk Insurance in North Carolina

First Insurance Services is proudly providing Builders Risk Insurance solutions to residents across North Carolina.

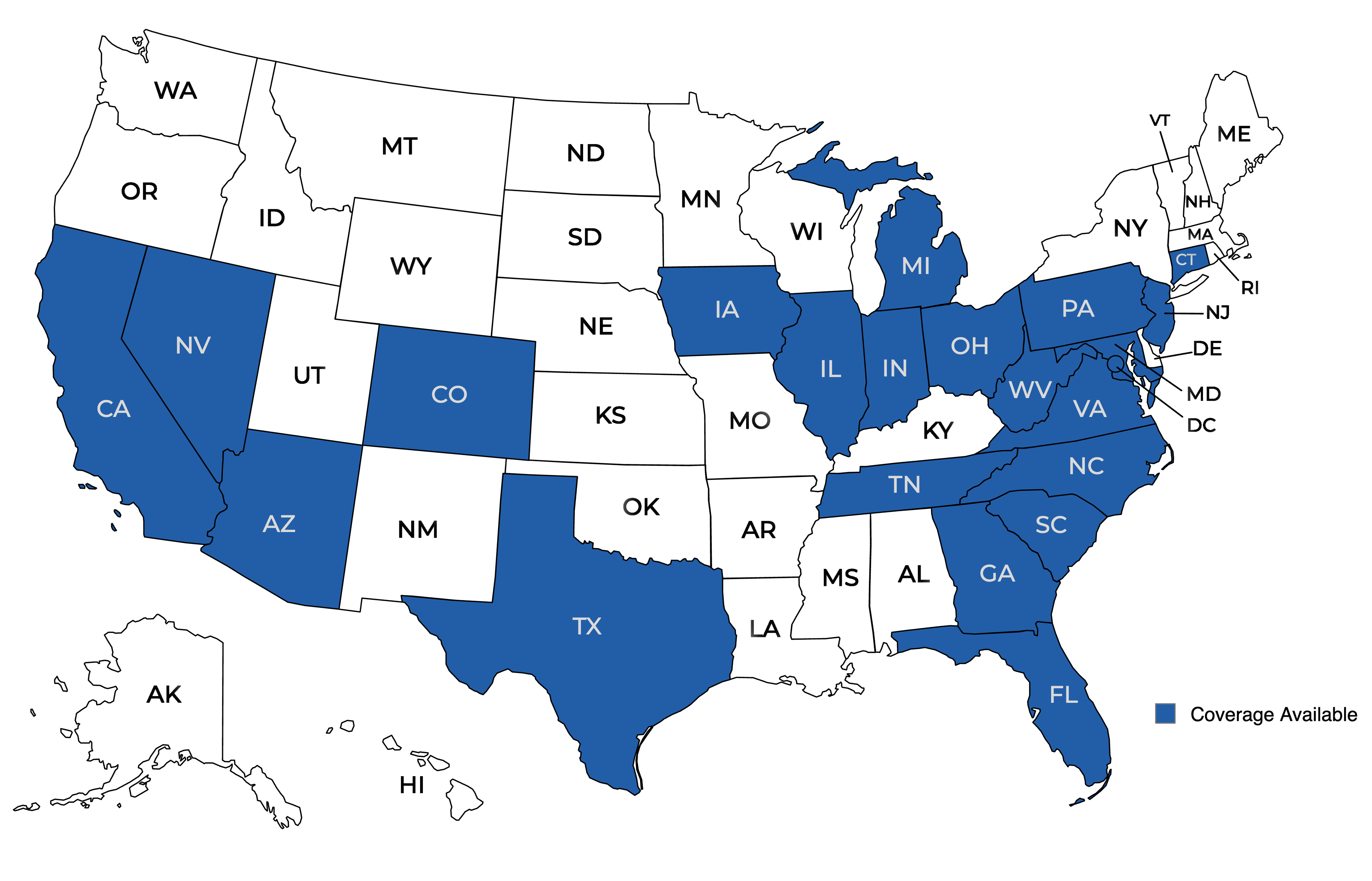

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Builders Risk Insurance in North Carolina

Navigating the complexities of builders risk insurance can be challenging, but we at First Insurance Services are here to help. We understand the importance of having solid coverages in place that’ll protect you, and our agents can guide you through selecting the right protections.

As experienced independent insurance agents in North Carolina, we know the complexities of builders risk insurance. We’ve worked with many other clients who needed to protect themselves, and our team has the expertise necessary to ensure you also find solid protection against the many risks that this insurance protects against. We work closely with every client to make sure they find exactly what they need, and we’ll treat you just as well as we do everyone who comes to us for assistance.

Getting the protection you need requires considering what coverages, deductibles, limits and other features are right for your particular situation. Not only will we help you think through those decisions, but you can trust us to recommend the best option that meets your requirements. We’ll give you choices from several insurance companies since we’re an independent agency. It’s then easy to pick the best one.

Leaving things to chance can be risky, potentially causing major financial or other losses if something happens. By opting for insurance today, you’ll be better prepared for what could happen tomorrow. Most of these policies can protect against a range of risks, too.

To begin the insurance selection process, get in touch with First Insurance Services. One of our expert North Carolina agents will walk you through the selection and comparison process, making sure you find a policy that’s fully customized for your specific situation. Together, we can find insurance that’ll give you peace of mind.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!