EPLI Insurance in North Carolina

First Insurance Services is proudly providing EPLI solutions to residents across North Carolina

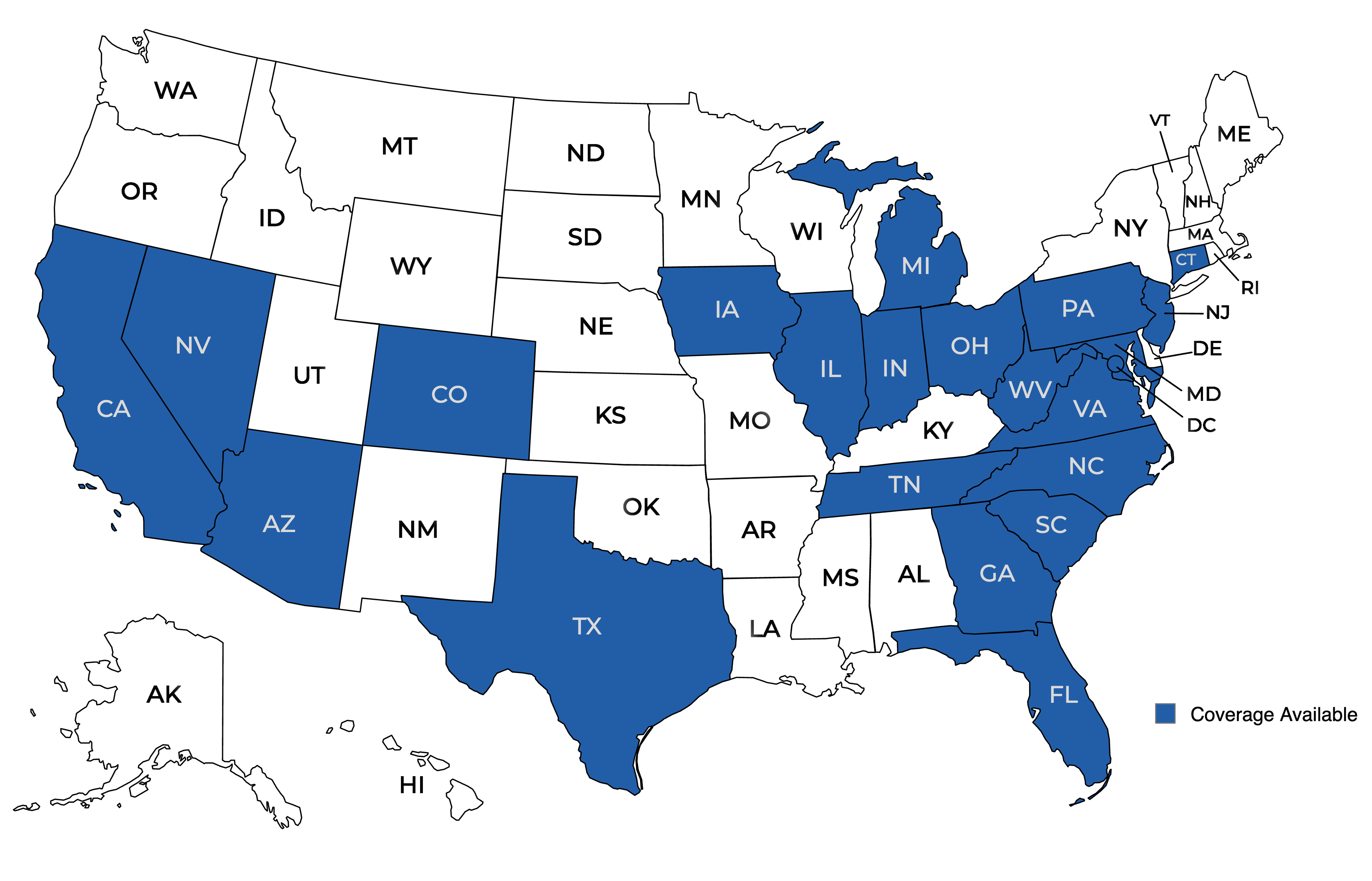

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Learn About EPLI Insurance in North Carolina

What is EPLI insurance?

Employees present certain risks to the businesses that hire them, as any employee could claim they were discriminated against and sue. EPLI insurance can help protect North Carolina employers from covered discrimination claims.

EPLI insurance is specialized liability coverage that generally protects against allegations of employment-related issues. It normally covers employee discrimination claims and other issues.

Like most liability coverages, EPLI typically pays legal fees and a settlement if there’s a covered claim (subject to any deductible or limit).

What businesses in North Carolina is Employment Practices Liability Insurance for?

Employment Practices Liability Insurance is something that the vast majority of employers in North Carolina should consider. A discrimination lawsuit can be costly if coverage isn’t in place.

Moreover, it’s generally recommended that businesses get this coverage before hiring their first employee. Before even posting a first job listing is usually preferable, as even job applicants might file discrimination claims.

What scenarios are typically covered by Employment Practices Liability Insurance?

Employment Practices Liability Insurance policies are designed to cover a variety of employment-related allegations. Depending on its specific terms, a policy might cover situations such as the following:

- Unpaid internships that should be compensated

- Gender-based pay disparities

- Age discrimination of older employees

- Sexual orientation discrimination of LGBTQ+ employees

- Racial discrimination of minorities

- Inappropriate interview questions

- Failure to disclose background checks that are run when hiring

- Hostile work environments

The discrimination issues may show up as unequal pay, disparities in duties that are assigned, disparities in shifts worked, restricted opportunities or other ways. A policy will typically cover many different kinds of potential discrimination,

Will EPLI cover a nonprofit if volunteers make discrimination claims?

Nonprofit organizations might get an EPLI policy not just for their employees, but also for volunteers. Even for unpaid volunteer positions, there still can be disparities in what responsibilities people are given, what opportunities they have, or when they’re scheduled to volunteer.

Not all EPLI policies offer coverage for volunteer issues, but these policies usually are available. An insurance agent specializing in EPLI can help nonprofit organizations find a policy that’ll cover employees and volunteers alike.

Is employment discrimination covered by workers compensation?

Workers compensation insurance generally doesn’t cover employment discrimination claims. It’s mainly for job-related injuries and illnesses that employees sustain.

EPLI is the specific coverage that normally addresses employment discrimination and related issues.

Does EPLI protect against discrimination claims made by customers?

While it’s less common, customers could also file a discrimination lawsuit. So too might vendors, and others who interact with a business but aren’t employees.

Select EPLI policies may offer protection against claims of discrimination that are made by customers or vendors. This coverage isn’t available in all EPLI policies, but might be in some policies.

If customer discrimination claims are of particular concern, an insurance agent who specializes in EPLI can help look for a policy that has coverage for third parties.

How much do businesses pay for EPLI coverage?

The premiums that businesses pay for EPLI coverage vary, as every employment situation is unique. Factors like industry, annual revenue and any past claims history often impact cost. So too do the number of employees, salaries of employees, business’s hiring and termination policies, and employee turnover rate.

An easy way to find out how much EPLI will be in a particular situation is to compare policy options with an independent insurance agent. Independent agents are able to check policies from multiple insurers, since they aren’t obligated to any single one.

How can North Carolina businesses get EPLI insurance?

If your North Carolina business needs help finding employment practices liability insurance, reach out to the independent insurance agents at First Insurance Services. We’ll make sure your business finds an EPLI insurance policy that’ll provide solid protection.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!