Commercial Property Insurance in North Carolina

First Insurance Services is proudly providing commercial property insurance solutions to residents across North Carolina

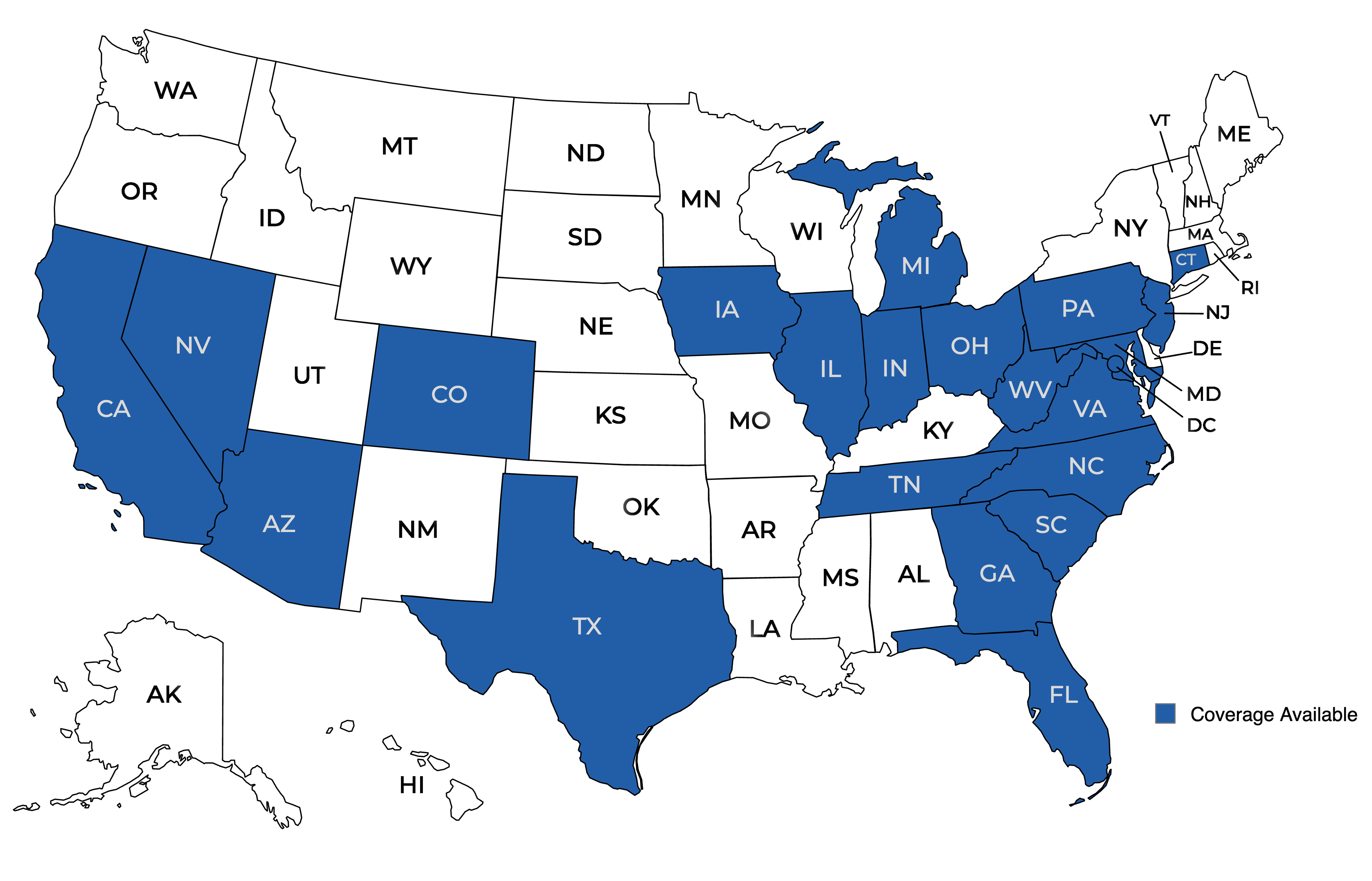

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Learn About Commercial Property Insurance in North Carolina

What is commercial property insurance?

Purchasing a commercial building, or any other commercial property, requires a sizeable investment. Commercial property insurance can help businesses with commercial buildings in North Carolina protect their investments.

Commercial property insurance offers customizable coverage for buildings and other commercial real estate. Policies may protect properties against a wide variety of perils.

What properties should North Carolina businesses get business property insurance for?

Business property insurance is generally advised for any building or land that a North Carolina business owns. It’s also broadly recommended for expensive equipment and large inventories. In short, most businesses have at least some assets that they might want a business property policy for.

In cases where properties are financed, insurance is often compulsory per lender requirement. Businesses usually should have insurance regardless of whether their property is financed, though.

What commercial properties can be insured with a business property policy?

Business property policies are available for most types of buildings that businesses would purchase. For example, office buildings, medical offices, retail stores, restaurant buildings, agricultural structures, warehouses and industrial facilities can all be insured. So too can specialized buildings, such as hospitals, schools and emergency response stations.

Most vacant properties can also be insured, and coverage is available for larger equipment and inventories.

What insurance coverages do business property policies make available?

Business property policies can come with a variety of important coverages. Exact coverage options can vary between policies, but they often include protections like:

Key coverage options include:

- Building Coverage: Normally protects the primary structure on the insured property, and may also cover other structures located on the property.

- Contents Coverage: Normally protects items kept at the insured property, such as equipment, product inventory, supplies, furniture, electronics and appliances.

- Exterior Signs Coverage: Normally protects detached outdoor signs not already covered under building coverage.

- Tenant Improvements Coverage: Normally protects improvements or modifications that tenants make to a space they lease.

Do business property insurance policies offer any liability protections?

Business property insurance policies normally don’t, themselves, come with and liability protections. Liability risks are normally addressed through various liability policies, as this allows for easier customization.

An insurance agent who helps with business property policies can also assist with commercial liability policies.

Are digital assets covered under this policy?

Business property policies also normally don’t cover non-physical assets. Data and other digital assets usually must be insured with a different insurance policy, whether that’s cyber insurance or something else.

Do commercial property policies cover equipment that’s at other locations?

Commercial property policies normally confine coverage to just the insured premises. While a policy may insure equipment when it’s at the insured premises, the policy is unlikely to cover when that equipment is taken elsewhere.

Businesses that regularly transport or keep equipment elsewhere might want inland marine insurance, builders risk insurance, or other coverages along with a commercial property policy.

Can multiple properties be insured with one commercial property policy?

Many commercial property policies are able to insure multiple business locations, provided that the policy is set up to cover several properties. A knowledgeable insurance agent can help businesses select and set up a policy that’ll cover multiple locations.

How much does insuring a commercial building cost?

The premiums charged for insuring commercial buildings vary, as they’re based on numerous factors. A building’s size, location, proximity to a fire station, construction, security systems and value are just some of the details that impact cost.

The simplest way to find out how much a particular building will cost to insure is by talking with an independent insurance agent. An independent agent can compare policies from several insurers, which makes it easy to find out the market rates for insuring a specific building.

How can North Carolina businesses get commercial property insurance?

For help insuring a commercial building or other property, reach out to the independent insurance agents at First Insurance Services. Our North Carolina agents will work closely with you to find commercial property insurance that has the protections your business’s property needs.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!