Nonprofit Insurance in North Carolina

First Insurance Services is proudly providing nonprofit insurance solutions to residents across North Carolina

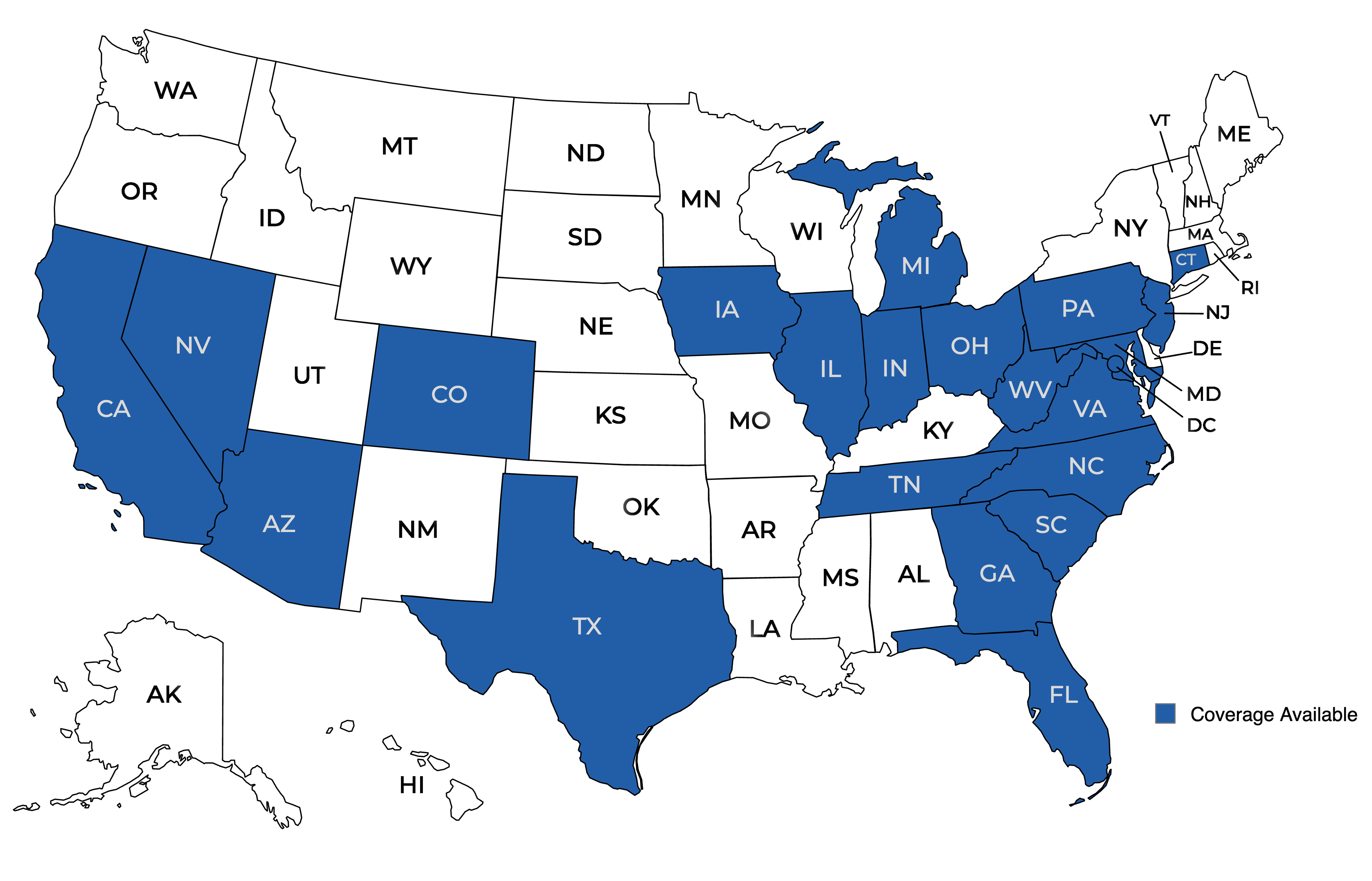

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Learn About Nonprofit Insurance in North Carolina

What is nonprofit insurance?

Running a nonprofit organization of any type or size comes with certain risks, and some organizations are exposed to quite substantial potential perils. To financially protect against many of the risks they face, nonprofit organizations in North Carolina can get nonprofit insurance.

Nonprofit insurance is designed to meet the insurance needs of not-for-profit organizations. Policies generally offer flexible coverages at affordable premiums.

What nonprofits in North Carolina should be carrying insurance?

Insurance is important for almost every not-for-profit, as virtually no organization is completely free of risk. The vast majority of 501(c)3s in North Carolina should consider a nonprofit policy.

Of course, this means that nonprofit policies are purchased by a wide variety of organizations. Some examples of the organizations that frequently get this type of insurance policy include:

- Religious organizations (i.e. churches, mosques, synagogues, temples)

- Educational programs (i.e. preschools, after-school programs, summer camps)

- Cultural centers (i.e. museums, theaters, Native American nonprofits)

- Advocacy groups (i.e. environmental advocates, social justice advocates)

- Land conservation groups (i.e. land trusts, land management nonprofits)

- Other charitable organizations (i.e. food pantries, animal shelters, housing organizations)

This isn’t to say that any one nonprofit policy is able to cover all of these organizations, but rather that there are policies available for the many different types of nonprofits. An insurance agent specializing in these policies can help nonprofits find a policy that matches their needs well.

What insurance coverages should not-for-profit organizations look for?

These policies typically provide nonprofit liability insurance coverages, and nonprofit property insurance coverages. Organizations should consider different protections within each of these categories.

Nonprofit liability insurance protections normally guard against various instances where the organization could be sued. These are most often situations where the organization is allegedly responsible for injury or property damage (not of its own property). There’s a range of nonprofit liability insurance coverages to consider:

- General Liability Coverage: May apply to common accidents. like slip-and-fall accidents and other basic accidents, causing third-party injury or property damage. Typically also includes coverage for defamation suits.

- Professional Liability Coverage: May apply to claims arising from work-related errors, typically covering employees and volunteers who provide advice or services in a professional capacity.

- Directors & Officers Liability Coverage: May apply to claims against nonprofit organization’s leaders, including chairpersons and board members, because of their decisions or actions.

- Employment Practices Liability Coverage: May apply to discrimination claims made by employees or volunteers, and also lawsuits alleging some other unlawful employment practices.

- Cyber Liability Coverage: May apply to online risks, such as data breaches, ransomware attacks and direct hacking attempts.

- Social Engineering Fraud Coverage: May apply to incidents stemming from fraudulent or deceptive misrepresentation.

- Special Events Coverage: May apply to specific events hosted by a nonprofit organization, often providing protection only for the duration of the event.

- Umbrella Coverage: May apply as an additional layer of liability protection, backing up another nonprofit liability insurance coverage if there’s a major lawsuit.

Property insurance protections generally insure items that nonprofits own, potentially covering everything from large buildings to minor supplies. Some protections and what they usually cover are as follows:

- Commercial Building Coverage: Usually protects buildings and other facilities owned by a nonprofit organization.

- Tenants Betterment Coverage: Usually protects changes and upgrades made to spaces leased by a nonprofit.

- Commercial Contents Coverage: Usually protects non-structural items that a nonprofit keeps at its location. May cover HVAC systems, appliances, specialized equipment, supplies, products and more.

- Inland Marine Coverage: Usually protects items such as equipment, supplies and products if they’re moved between locations.

- Commercial Auto Coverage: Usually protects against damage to vehicles owned by a nonprofit organization, and also typically provides liability coverage for accidents.

When do nonprofit organizations need liquor liability coverage?

Liquor liability coverage is often recommended whenever nonprofits serve alcohol. This is most often at special events, whether holiday parties, fundraisers, festivals or other celebrations.

If liquor liability is needed for an event, a knowledgeable insurance agent should be able to assist with finding coverage.

How can North Carolina nonprofits find nonprofit insurance?

If you run a not-for-profit in North Carolina that needs insurance, contact the independent insurance agents at First Insurance Services. We’ll make sure you find nonprofit insurance that’ll protect your organization well.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!