Homeowners Insurance in North Carolina

First Insurance Services is proudly providing homeowners insurance to residents across North Carolina

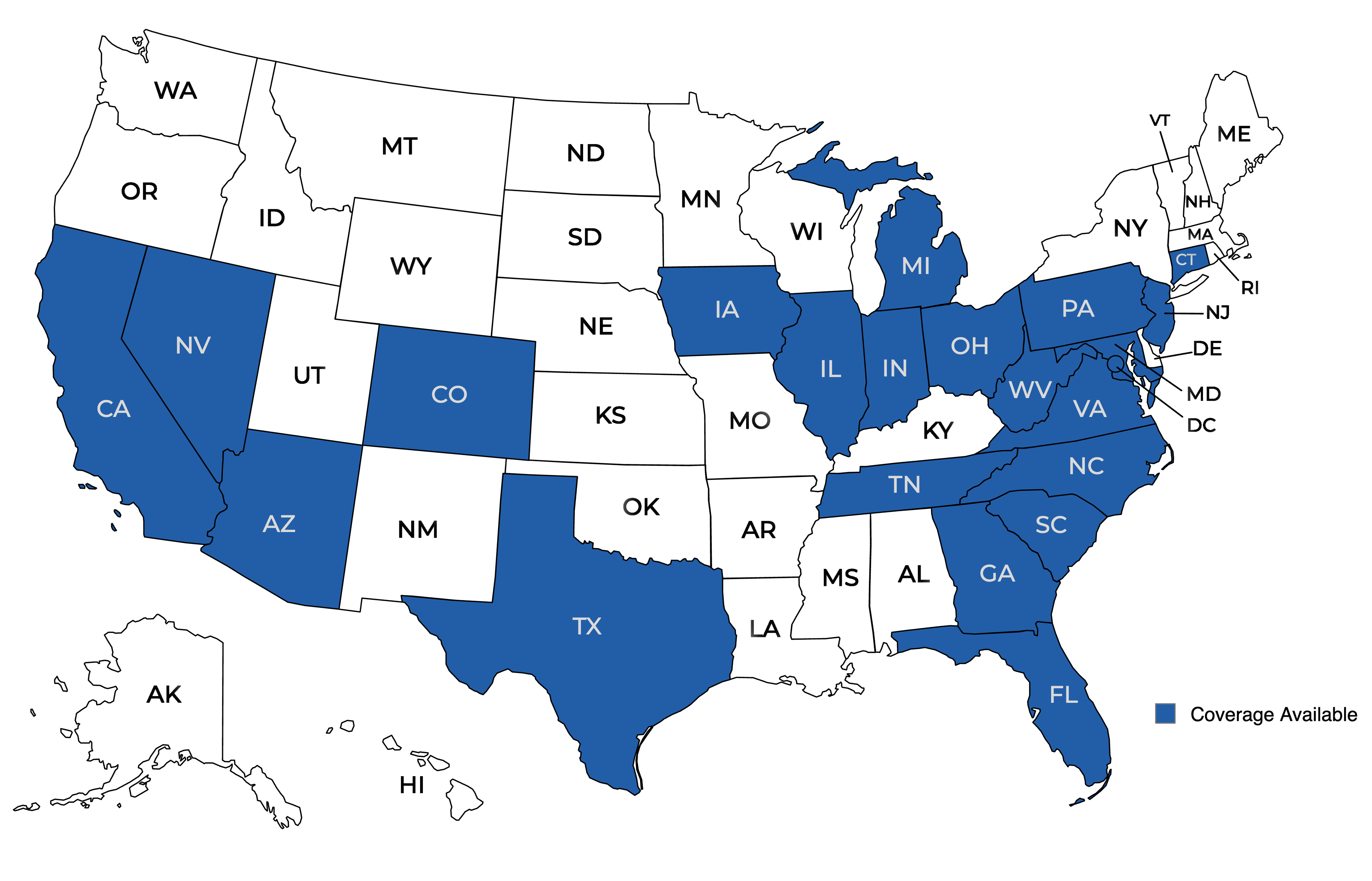

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Learn About Homeowners Insurance Quotes in North Carolina

Homeowners Insurance North Carolina

If you own a home in North Carolina, it’s important to protect your investment with homeowners insurance. But with so many options and factors to consider, it can be overwhelming to navigate the world of homeowners insurance. In this article, we’ll break down everything you need to know about homeowners insurance in North Carolina, from what it covers to how to get the best rates.

What is Homeowners Insurance?

Homeowners insurance is a type of insurance that provides financial protection for your home and personal belongings in the event of damage or loss. It also offers liability coverage in case someone is injured on your property.

While homeowners insurance is not legally required in North Carolina, most mortgage lenders will require you to have it. Even if you own your home outright, it’s still a good idea to have homeowners insurance to protect your investment. Most people could not afford to rebuild if the worst happens.

What Does Homeowners Insurance Cover?

Homeowners insurance typically covers damage or loss caused by fire, theft, vandalism, and certain natural disasters. It also provides liability coverage in case someone is injured on your property and you are found liable.

There are different types of coverage within a homeowners insurance policy, including:

- Dwelling coverage: This covers the cost of repairing or rebuilding your home if it is damaged or destroyed by a covered event.

- Personal property coverage: This covers the cost of replacing your personal belongings, such as furniture, clothing, and electronics, if they are damaged or stolen.

- Liability coverage: This covers legal fees and damages if someone is injured on your property and you are found liable.

- Additional living expenses coverage: This covers the cost of temporary housing and other expenses if your home is uninhabitable due to a covered event.

Average Cost of Homeowners Insurance in North Carolina

The average cost of homeowners insurance in North Carolina is $1,086 per year, which is slightly lower than the national average of $1,211 per year. However, the cost of homeowners insurance can vary greatly depending on factors such as the location and age of your home, your credit score, and the amount of coverage you need.

To get an accurate estimate of how much homeowners insurance will cost for your specific home, it’s best to get quotes from multiple insurance companies.

How to Get Homeowners Insurance Quotes

When shopping for homeowners insurance, it’s important to get quotes from multiple insurance companies to ensure you’re getting the best rates. Here are some steps to follow when getting homeowners insurance quotes:

- Determine the amount of coverage you need: Before getting quotes, it’s important to know how much coverage you need for your home and personal belongings. This will help you compare quotes more accurately.

- Research insurance companies: Look for insurance companies that have a good reputation and offer competitive rates. You can also ask friends and family for recommendations.

- Get quotes from multiple companies: Contact at least three insurance companies and request quotes for the same amount of coverage. This will allow you to compare rates and coverage options.

- Review the quotes: Once you receive the quotes, review them carefully to ensure they include all the coverage you need and that there are no hidden fees.

- Choose the best option: After comparing quotes, choose the insurance company that offers the best coverage and rates for your needs.

Tips for Lowering Your Homeowners Insurance Rates

While homeowners insurance is an important investment, it’s also important to find ways to lower your rates. Here are some tips for getting the best rates on homeowners insurance in North Carolina:

- Bundle your insurance policies: Many insurance companies offer discounts if you bundle your homeowners insurance with other policies, such as auto insurance.

- Improve your credit score: Insurance companies often use credit scores to determine rates, so improving your credit score can help lower your homeowners insurance rates.

- Increase your deductible: A higher deductible means a lower premium, so consider increasing your deductible if you can afford to pay more out of pocket in the event of a claim.

- Install safety features: Installing safety features such as smoke detectors, security systems, and deadbolt locks can help lower your homeowners insurance rates.

- Shop around: As mentioned earlier, it’s important to get quotes from multiple insurance companies to ensure you’re getting the best rates.

How Can Homeowners in North Carolina Get Homeowners Insurance?

Homeowners insurance is an essential investment for anyone who owns a home in North Carolina. It provides financial protection for your home and personal belongings, as well as liability coverage in case someone is injured on your property.

To begin the process, get in touch with the team at First Insurance Services. One of our expert North Carolina agents will walk you through the selection and comparison process, making sure you find a policy that’s fully customized for your specific situation. Together, we can find insurance that’ll give you peace of mind.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!