Cyber Insurance in North Carolina

First Insurance Services is proudly providing cyber insurance solutions to residents across North Carolina

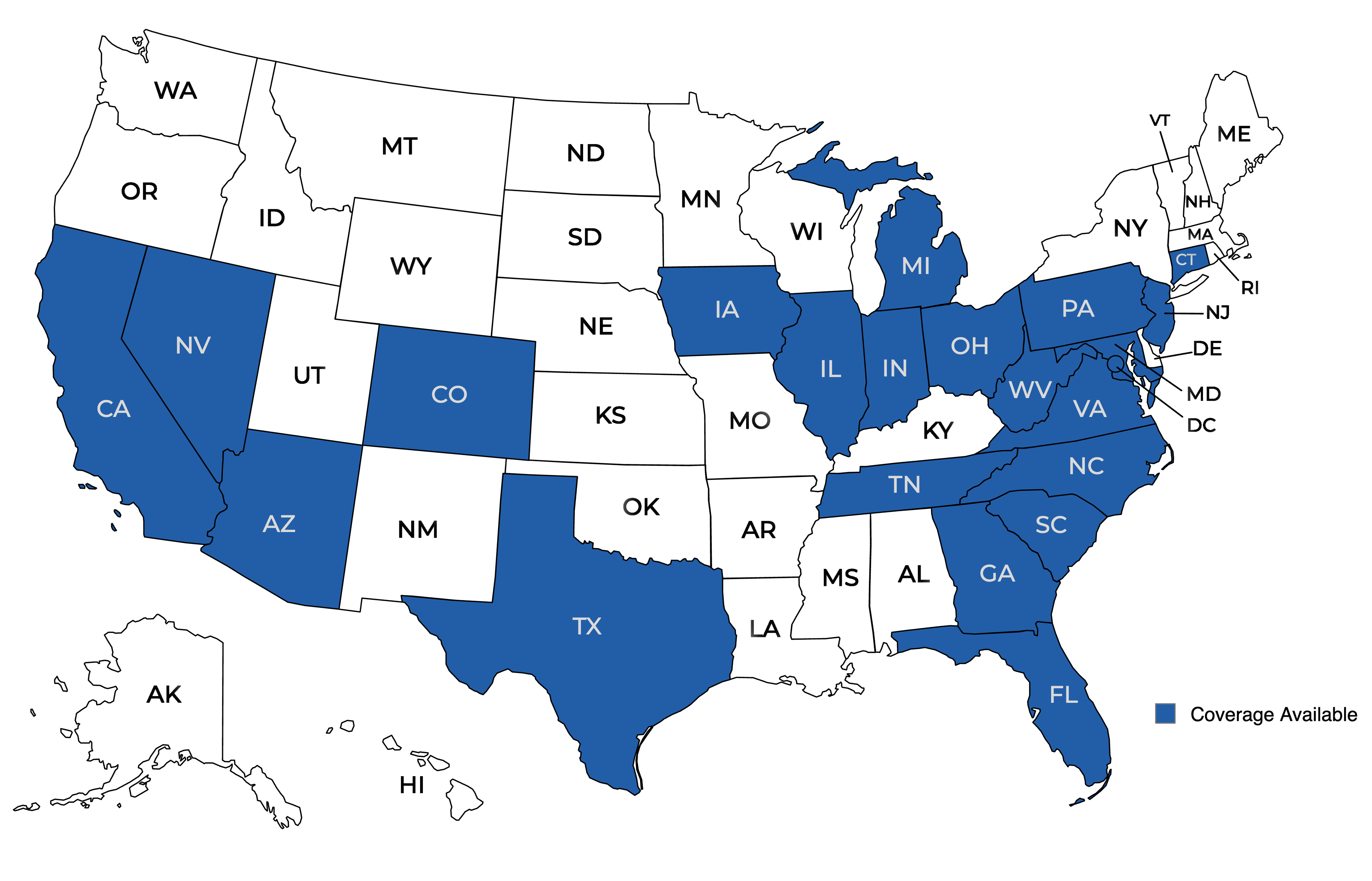

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Cyber Insurance in North Carolina

What is cyber insurance?

Businesses today are increasingly vulnerable to cyber crimes. The Department of Justice reports in one survey that 99% of companies with computers have experienced cybercrime threats. Cyber insurance may help protect North Carolina businesses from the financial risks that these sorts of threats pose.

Cyber insurance generally provides protection against today’s online and digital risks. It may help with legal costs, settlements and other expenses in the event of a covered data breach.

Which North Carolina businesses need cyber liability insurance?

Given the prevalent risk of digital threats, most businesses in North Carolina should consider cyber liability insurance. Almost all businesses are exposed, and a single attack could be costly.

What sorts of threats and incidents does cyber liability insurance protect against?

Cyber liability policies may provide protection in a host of potential scenarios. The exact protections that a policy offers depend on the specifics of that policy, but they could extend to situations such as the following:

- Client social security and account numbers are stolen through a successful attack on an investment advisor’s system.

- Confidential legal documents are accidentally emailed to the wrong party by a law firm’s paralegal.

- The wrong patient’s EHRs are sent to another party, potentially causing a HIPAA violation for a medical practice.

- Customer credit card numbers are stolen by a skimmer installed at a gas station pump.

- An employee compromises sensitive information as they fall victim to a phishing email scam.

- A remote employee forgets their laptop at an airport while traveling, potentially compromising the data on it.

In these and similar situations, whoever has information compromised might seek compensation and protection from the business.

What cyber liability insurance coverages should businesses look for?

Cyber liability policies may come with multiple coverages that may be important to businesses. Some common protections are:

- Employee Privacy Liability Coverage: Often covers situations involving the compromise of employee personal data, such as Social Security numbers or direct deposit bank information.

- Network Security Privacy Liability Coverage: Often covers data breaches leading to violations of federal or state laws, such as violations of HIPAA.

- Electronic Media Coverage: Often covers claims related to trademark infringement, defamation or plagiarism that are made over online content.

Are cyber liability policies able to cover third-party data breaches?

Businesses that keep data with third parties may be exposed if those parties suffer a data breach. Even if a third party is at fault for a breach, it’s possible that the business using the third party is also sued. This is becoming a more common risk as more businesses hire cloud-based storage and software services.

While not standard in all policies, some cyber liability policies might offer protection for third-party breaches. Businesses that specifically want this protection should consult with an insurance agent who knows cyber liability coverages well. A specialized agent will be able to check for protection.

What sorts of incidents are covered by cyber liability?

Depending on a policy’s coverages and terms, cyber liability might protect against:

- Online attacks against computers or servers

- Network security breaches

- Employee theft of digital files

- Phishing email scams

- Accidental breaches (including human error)

When there’s a covered incident, a policy might help pay credit monitoring costs, data recovery costs, and lost revenue due to the breach.

Does commercial property insurance protect online data?

Commercial property insurance is mainly for physical assets, and it usually doesn’t protect digital ones. While a commercial property policy would likely protect a computer against loss, it probably wouldn’t cover files on that computer.

For digital assets, files and data, cyber liability coverage is normally needed.

How much does it cost to purchase cyber liability coverage?

The cost of cyber liability coverage varies substantially. A business’s type of data, online operations, coverage needs and any past claims can all impact cost, as can many other details.

For help checking premiums, businesses can reach out to an independent insurance agent. Independent agents are able to compare policy options from among multiple insurers, checking both protections and premiums.

Where can North Carolina businesses find cyber insurance?

For assistance with cyber insurance, contact the independent insurance agents at First Insurance Services. Our North Carolina agents will make sure your business is well protected against today’s many online risks.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!