Commercial Auto Insurance Quotes in North Carolina

First Insurance Services is proudly providing commercial auto insurance quotes to residents across North Carolina

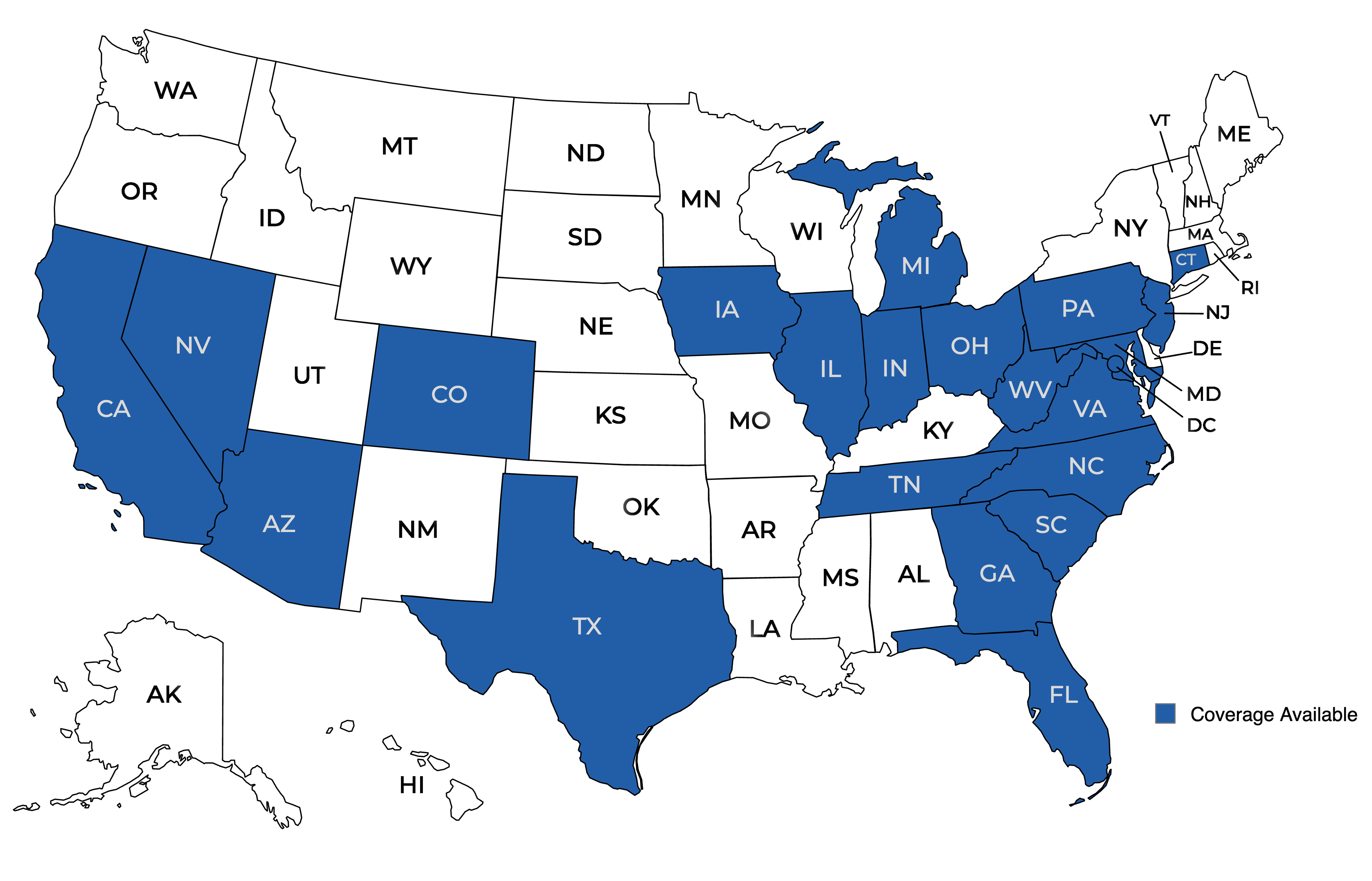

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Learn About Commercial Auto Insurance Quotes in North Carolina

Commercial Auto Insurance Quotes in North Carolina

If you own a business in North Carolina that requires the use of vehicles, it’s important to have the right insurance coverage. Commercial auto insurance protects your business from financial loss in the event of an accident or damage to your vehicles. But with so many options and factors to consider, it can be overwhelming to navigate the world of commercial auto insurance. In this article, we’ll answer some frequently asked questions about commercial auto insurance quotes in North Carolina to help you make an informed decision.

What is Commercial Auto Insurance?

Commercial auto insurance is a type of insurance that provides coverage for vehicles used for business purposes. This can include cars, trucks, vans, and other types of vehicles. It is designed to protect your business from financial loss in the event of an accident, theft, or damage to your vehicles.

Do I Need Commercial Auto Insurance in North Carolina?

If you use vehicles for business purposes in North Carolina, you are legally required to have commercial auto insurance. This includes vehicles used for transporting goods, employees, or clients, as well as vehicles used for commercial purposes such as construction or landscaping.

What Does Commercial Auto Insurance Cover?

Commercial auto insurance typically covers liability, collision, and comprehensive coverage. Liability coverage protects your business from financial loss if you are at fault in an accident and someone else is injured or their property is damaged. Collision coverage covers damage to your vehicle in the event of an accident, regardless of who is at fault. Comprehensive coverage protects your vehicle from non-collision events such as theft, vandalism, or natural disasters.

How Do I Get Commercial Auto Insurance Quotes in North Carolina?

There are several ways to get commercial auto insurance quotes in North Carolina. You can contact insurance companies directly, work with an insurance broker, or use online comparison tools. It’s important to get quotes from multiple sources to ensure you are getting the best coverage at the best price.

What Factors Affect My Commercial Auto Insurance Quotes?

Several factors can affect your commercial auto insurance quotes in North Carolina, including:

- The type of vehicles you use for business

- The number of vehicles you need to insure

- The driving records of your employees

- The coverage limits and deductibles you choose

- The location and size of your business

- The industry your business operates in

How Much Does Commercial Auto Insurance Cost in North Carolina?

The cost of commercial auto insurance in North Carolina can vary depending on the factors mentioned above. On average, businesses in North Carolina can expect to pay between $1,000 and $3,000 per vehicle per year for commercial auto insurance.

Are There Ways to Save on Commercial Auto Insurance?

Yes, there are several ways to save on commercial auto insurance in North Carolina. Some insurance companies offer discounts for bundling multiple policies, having a good driving record, or installing safety features on your vehicles. It’s also important to regularly review your coverage and make adjustments as your business grows and changes.

What Should I Look for in a Commercial Auto Insurance Policy?

When comparing commercial auto insurance quotes in North Carolina, there are a few key things to look for in a policy:

- Coverage limits: Make sure the policy provides enough coverage to protect your business in the event of an accident or damage to your vehicles.

- Deductibles: Consider the amount you will need to pay out of pocket before insurance coverage kicks in.

- Exclusions: Be aware of any exclusions in the policy that may limit coverage for certain types of accidents or events.

- Additional coverage options: Some policies may offer additional coverage options such as roadside assistance or rental reimbursement.

- Customer service: Look for an insurance company with a good reputation for customer service and claims handling.

What Happens if I Don’t Have Commercial Auto Insurance in North Carolina?

If you are caught driving without commercial auto insurance in North Carolina, you could face fines, license suspension, or even criminal charges. Additionally, if you are involved in an accident without insurance, your business could be held liable for all damages and expenses.

Can I Use Personal Auto Insurance for Business Vehicles?

No, personal auto insurance policies typically do not cover vehicles used for business purposes. If you use your personal vehicle for business, it’s important to inform your insurance company and discuss the need for a commercial auto insurance policy.

What Should I Do After an Accident?

If you are involved in an accident, it’s important to take the following steps:

- Check for injuries and call for medical assistance if needed.

- Contact the police to report the accident.

- Exchange information with the other driver(s) involved.

- Take photos of the accident scene and any damage to your vehicle.

- Contact your insurance company to file a claim.

How Do I File a Claim for Commercial Auto Insurance?

If you are involved in an accident or your vehicle is damaged, you should contact your insurance company as soon as possible to file a claim. They will guide you through the process and provide instructions for submitting any necessary documentation.

Why Should I Use an Independent Insurance Agent to Find a Commercial Auto Insurance Quote?

Choosing an independent insurance agent offers several advantages when seeking commercial auto insurance quotes. Unlike captive agents who work for a specific insurance company, independent agents have the flexibility to explore multiple insurance options, providing you with a broader range of choices.

An independent agent can assess your business’s unique needs and match them with policies from different insurers. This personalized approach ensures that you receive tailored coverage at the best possible rates. Additionally, independent agents are often more accessible and responsive, providing ongoing support and assistance throughout the policy term.

How Can Businesses in North Carolina Get A Commercial Auto Quote?

In conclusion, whether you’re a small business owner or manage a larger enterprise, investing time in researching and obtaining commercial auto insurance quotes is a proactive measure that pays off in the long run. Remember, a well-informed decision today ensures a secure and resilient future for your business. If you’re ready to explore your commercial auto insurance options in North Carolina, contact First Insurance Services today for personalized guidance and competitive quotes. Your business deserves the protection it needs to thrive.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!