Workers Compensation Insurance in North Carolina

First Insurance Services is proudly providing workers compensation insurance solutions to residents across North Carolina

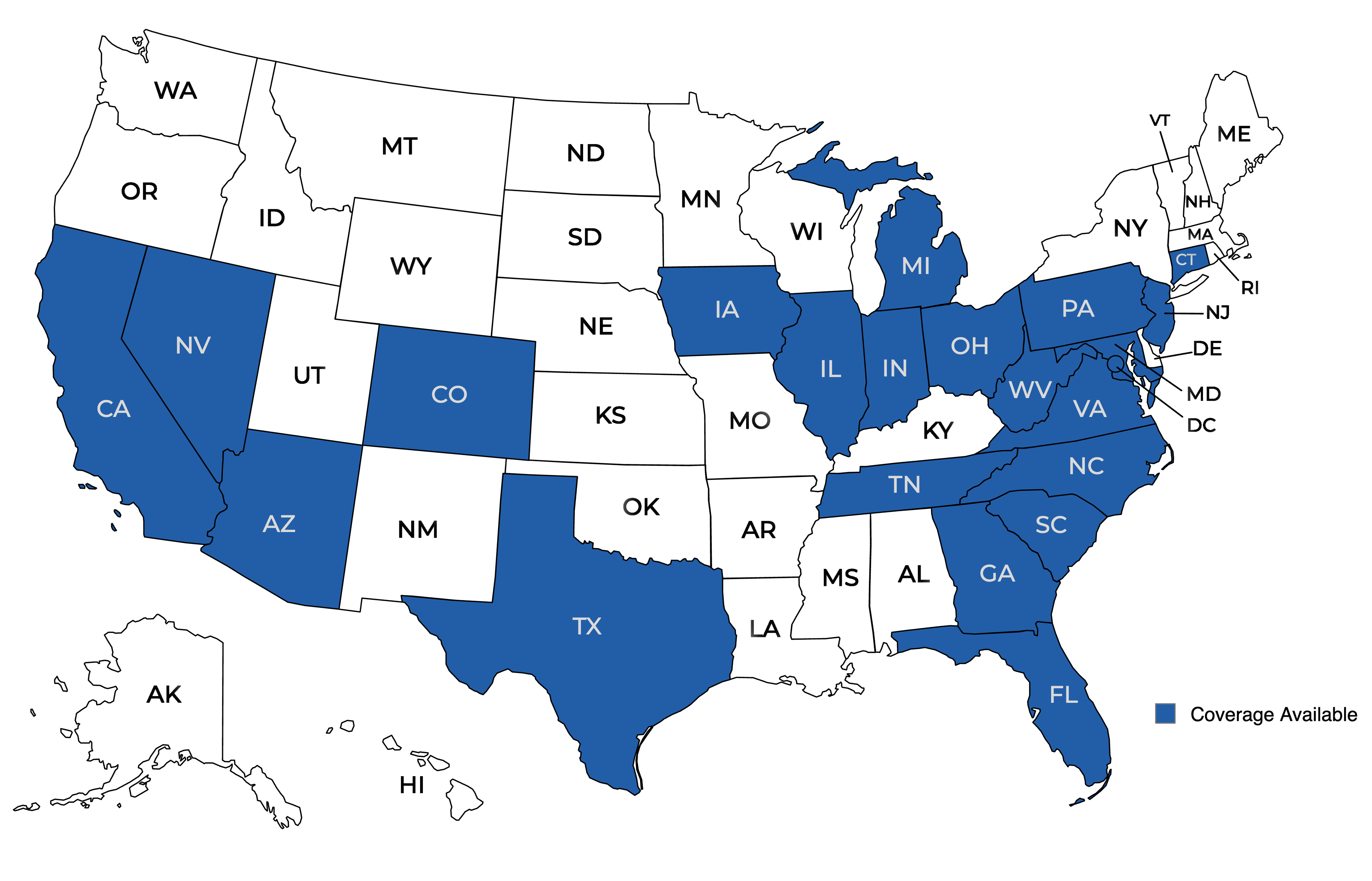

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Learn About Workers Compensation Insurance in North Carolina

Workers Compensation Insurance in North Carolina

Navigating the complexities of workers compensation insurance can be daunting.

Understanding its intricacies is crucial for both employers and employees.

In this comprehensive FAQ guide, we delve into the world of workers compensation insurance. We aim to clarify common misconceptions, answer frequently asked questions, and provide guidance on managing this essential coverage.

Our focus is on North Carolina, but the insights offered are valuable for anyone seeking to understand workers comp.

From legal requirements to claim filing processes, we cover it all.

Whether you’re a business owner, HR professional, or an employee, this guide is designed to equip you with the knowledge you need.

What is Workers Compensation Insurance?

Workers compensation insurance is a type of coverage that protects employees who get injured or become ill due to their job.

It’s designed to cover medical expenses and wage replacement for the affected workers.

This insurance is not just beneficial for employees. It also protects employers from potential lawsuits filed by injured employees.

In essence, it serves as a safety net for both parties involved.

Understanding its purpose and how it works is the first step in managing this crucial aspect of occupational safety and health.

Who Needs Workers Compensation Insurance in North Carolina?

In North Carolina, the law requires businesses with three or more employees to carry workers compensation insurance. This includes full-time, part-time, and seasonal workers.

Even some contractors may be considered employees under the law. However, there are exceptions to this rule. For instance, certain agricultural and domestic workers may not require coverage. It’s crucial for businesses to understand these requirements to avoid penalties and ensure protection for their employees.

What Types of Injuries and Illnesses Are Covered?

Workers compensation insurance covers injuries and illnesses that occur as a result of employment. This includes accidents that happen at the workplace, like slips, falls, or machinery accidents. It also covers illnesses that are contracted due to the nature of the job. For example, a lung disease from exposure to harmful chemicals.

In some cases, workers comp may cover injuries that occur outside the workplace, if they are job-related. However, it’s important to note that not all injuries or illnesses are covered. Each claim is evaluated on a case-by-case basis.

How Are Workers Compensation Insurance Premiums Calculated?

The calculation of workers compensation insurance premiums involves several factors.

Firstly, the nature of the business and the associated risks play a significant role.

Secondly, the number of employees and their job classifications are considered.

Thirdly, the company’s claim history, also known as the experience modification rate (EMR), is taken into account.

Lastly, the location of the business can also affect the premium.

Here’s a simplified breakdown:

- Business type and associated risks

- Number of employees and job classifications

- Company’s claim history (EMR)

- Business location

Remember, each insurance company may use a slightly different formula for calculating premiums. It’s always a good idea to consult with an insurance professional to understand how your premium is determined.

What is a Workers Compensation Insurance Certificate?

A workers compensation insurance certificate is a crucial document. It serves as proof that a business carries workers compensation insurance. This certificate outlines the coverage limits and the policy period.

It’s often required when a business is hiring contractors or engaging in partnerships. In essence, it provides assurance that the business is compliant with state laws and can cover potential workers comp claims.

What is the Difference Between Workers Compensation and Occupational Insurance?

Workers compensation and occupational insurance are often confused. However, they serve different purposes. Workers compensation insurance provides benefits to employees who suffer work-related injuries or illnesses. It covers medical expenses, lost wages, and rehabilitation costs.

On the other hand, occupational insurance is more flexible. It can be tailored to cover specific risks associated with certain occupations. However, it doesn’t provide the same level of protection as workers comp. For instance, it may not cover legal costs if an employee sues for damages.

How Does Workers Comp Benefit Employers and Employees?

Workers comp offers benefits to both employers and employees. For employees, it provides financial protection in case of work-related injuries or illnesses. It covers medical expenses, rehabilitation costs, and a portion of lost wages.

For employers, workers comp protects against potential lawsuits from injured employees. In essence, it provides a safety net for both parties, promoting a safer and more secure work environment.

What Are the Penalties for Not Having Workers Comp in North Carolina?

In North Carolina, failing to carry workers comp can lead to severe penalties. The North Carolina Industrial Commission can impose fines on businesses.

These fines can be as high as $100 per day, up to a maximum of $36,500 per year. In extreme cases, non-compliant businesses may face criminal charges.

Therefore, it’s crucial for businesses to maintain adequate workers comp coverage to avoid these penalties.

How to File a Workers Compensation Claim?

Filing a workers compensation claim involves several steps. First, the injured worker must report the injury to their employer. The employer then files a claim with their insurance company. The insurance company reviews the claim and makes a decision.

If the claim is denied, the worker can appeal to the North Carolina Industrial Commission.

What Are Common Exclusions in Workers Compensation Policies?

Workers compensation policies often exclude certain types of injuries. For instance, injuries that occur while the employee is intoxicated or committing a crime are typically not covered. Similarly, injuries that are self-inflicted or result from a pre-existing condition may also be excluded.

How Can Businesses in North Carolina Get Workers Compensation Insurance?

Workers Compensation Insurance is a fundamental aspect of responsible business management in North Carolina. From medical expenses to lost wages, the coverage it provides ensures that both employers and employees are protected in the event of work-related injuries or illnesses. If you’re a business owner in North Carolina looking for personalized Workers Compensation Insurance solutions, contact First Insurance Services today. Your commitment to the well-being of your workforce deserves the right insurance coverage.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!