Professional Liability Insurance in North Carolina

First Insurance Services is proudly providing professional liability insurance solutions to residents across North Carolina

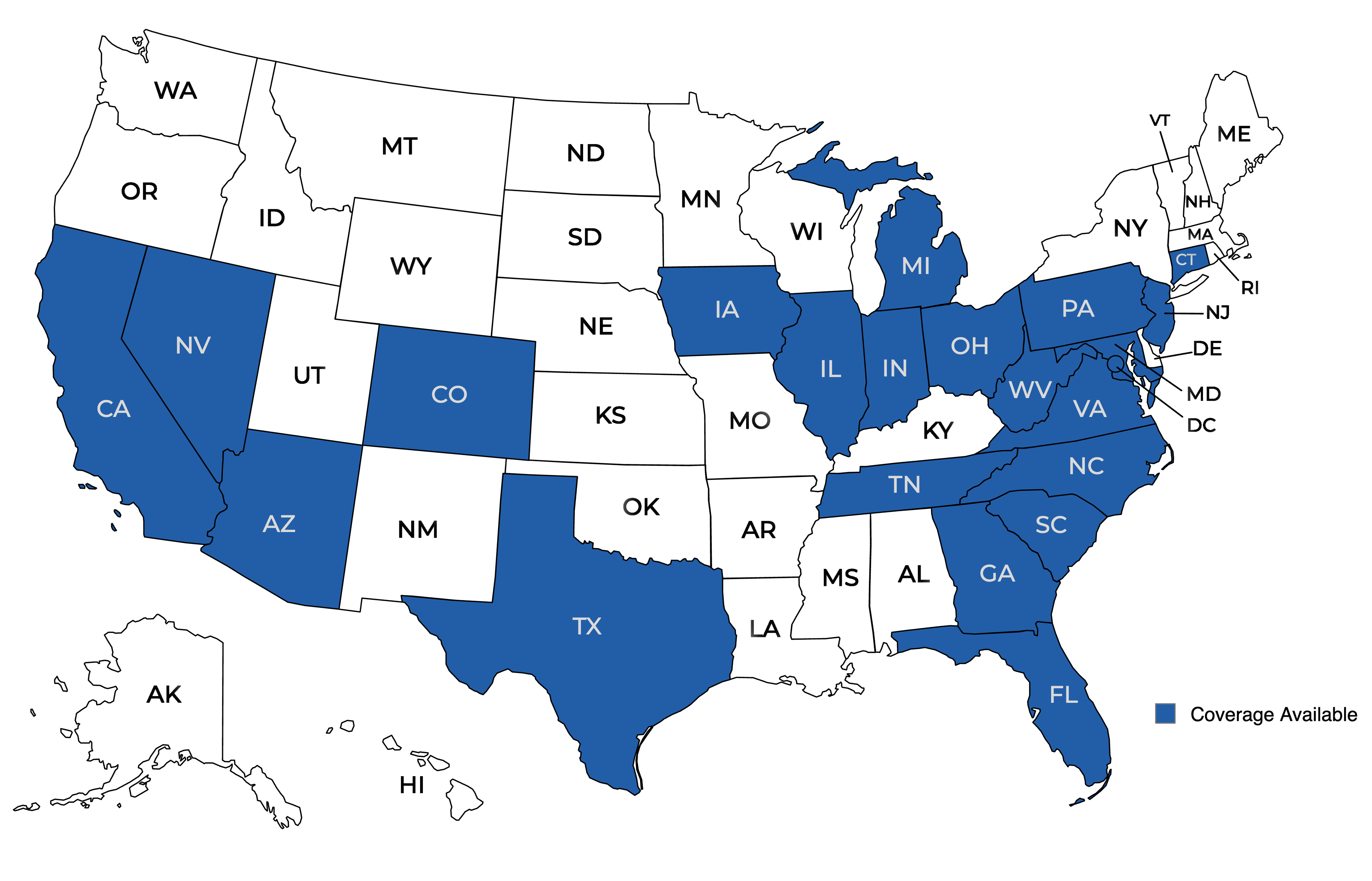

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Learn About Professional Liability Insurance in North Carolina

What Is Professional Liability Insurance?

Professional Liability Insurance, also known as Errors and Omissions (E&O) insurance, is a crucial safeguard for businesses and professionals in North Carolina. This specialized coverage protects individuals and companies from financial losses resulting from claims of negligence, errors, or omissions in the provision of professional services.

In North Carolina, where the business landscape is diverse and dynamic, having Professional Liability Insurance is a strategic move to mitigate the risks associated with providing services in various industries.

What North Carolina Businesses Should Consider Professional Liability Insurance?

Professionals across a wide array of industries in North Carolina should consider obtaining Professional Liability Insurance. This includes but is not limited to:

- Legal Professionals: Attorneys, paralegals, and law firms operating in North Carolina can benefit significantly from Professional Liability Insurance, especially considering the complexities of legal practice.

- Medical Practitioners: Doctors, nurses, and other healthcare professionals face unique challenges in their field. Professional Liability Insurance is essential for protecting against claims related to medical errors, misdiagnoses, or other professional oversights.

- Consultants and Advisors: Business consultants, financial advisors, and other professionals offering advisory services can find themselves exposed to legal claims. Professional Liability Insurance is crucial for safeguarding their businesses.

- Technology and IT Professionals: As North Carolina’s technology sector continues to grow, professionals in IT, software development, and cybersecurity should consider Professional Liability Insurance to shield against claims related to data breaches, software failures, or other tech-related issues.

- Architects and Engineers: Those involved in the design and construction industry can benefit from Professional Liability Insurance, protecting them from claims arising due to design flaws, project delays, or construction errors.

What Does Professional Liability Insurance Cover?

Professional Liability Insurance in North Carolina provides coverage for legal defense costs, settlements, and judgments arising from claims of professional negligence, errors, or omissions. This can include:

- Legal Fees: Coverage for the costs associated with hiring legal representation, whether the claim goes to court or is settled outside.

- Settlements and Judgments: Professional Liability Insurance helps cover the costs of settlements or court-ordered judgments in favor of the claimant.

- Damages: Financial compensation for damages suffered by the claimant due to the alleged professional negligence.

- Legal Malpractice: Professional Liability Insurance often includes coverage specifically for legal malpractice, protecting attorneys and law firms from claims related to their professional services.

Who Is Legal Malpractice Coverage For?

Legal malpractice coverage is designed specifically for attorneys and law firms. In North Carolina, where the legal profession is highly regulated, having this additional layer of protection is crucial. Legal malpractice claims can arise from various situations, including failure to meet deadlines, conflicts of interest, or inadequate legal representation. Having Professional Liability Insurance with legal malpractice coverage ensures that legal professionals can navigate their responsibilities with confidence.

Who Usually Pays The Premiums For Professional Liability Coverage?

The responsibility for paying Professional Liability Insurance premiums varies depending on the business structure and agreements in place. In many cases:

- Sole Proprietors: As individual practitioners, sole proprietors typically bear the cost of their Professional Liability Insurance premiums.

- Partnerships: In partnerships, the cost may be shared among the partners, depending on the terms outlined in the partnership agreement.

- Corporations: In corporate settings, the company often covers the premiums for Professional Liability Insurance to protect its assets and reputation.

Navigating the complexities of insurance coverage in North Carolina requires careful consideration of the specific needs of each professional and business. It’s essential to consult with an experienced insurance provider like First Insurance Services to tailor a Professional Liability Insurance policy that aligns with the unique risks faced in the Tar Heel State.

How Can Businesses in North Carolina Get Professional Liability Coverage?

Investing in Professional Liability Insurance in North Carolina is a proactive and strategic measure for professionals across diverse industries. It not only provides financial protection but also instills confidence in clients and enhances the overall resilience of businesses and individuals offering professional services. For personalized guidance and tailored insurance solutions, contact First Insurance Services today. Your peace of mind is our priority.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!