Homeowners Insurance Quotes in North Carolina

First Insurance Services is proudly providing homeowners insurance quotes to residents across North Carolina

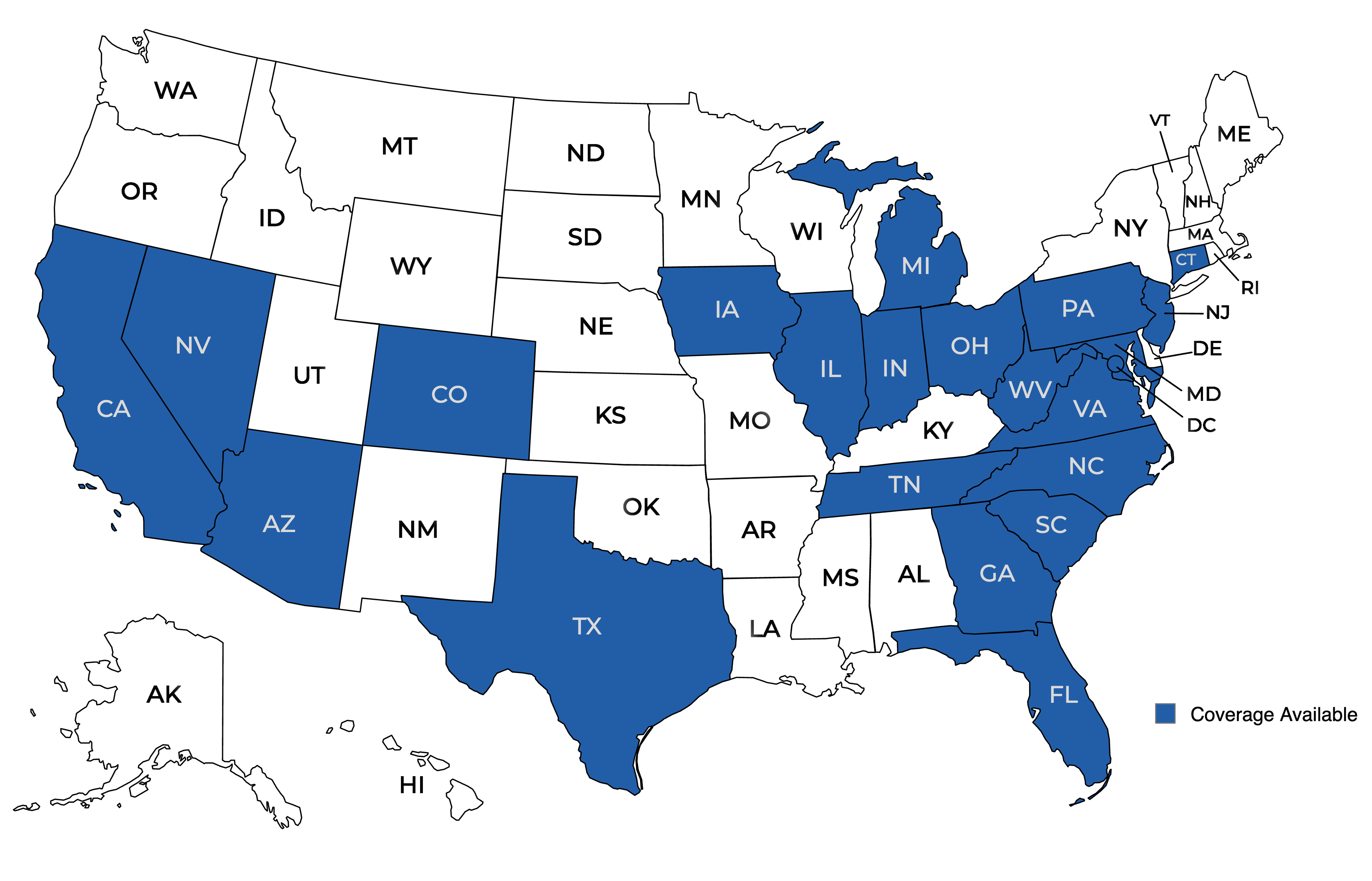

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Learn About Homeowners Insurance Quotes in North Carolina

Homeowners Insurance Quotes in North Carolina

Are you a homeowner in North Carolina? If so, you may be wondering if you have the right homeowners insurance coverage and if you are getting the best rate. With the cost of homeowners insurance on the rise, it’s important to regularly review your policy and shop around for quotes. In this article, we’ll discuss why you should get a new insurance quote, what homeowners insurance covers, and why shopping your policy is important.

What Is Homeowners Insurance?

Homeowners insurance is a type of insurance that protects your home and personal belongings from damage or loss. It also provides liability coverage in case someone is injured on your property. In North Carolina, homeowners insurance is not required by law, but it is highly recommended to protect your investment.

If you have a mortgage, it’s likely that your mortgage lender will require you to carry homeowners insurance. Most mortgage lenders require home insurance coverage up to the rebuilding cost of your home but, depending on circumstances in your specific location, like the climate, additional coverage for flooding or earthquakes may be required.

What Does Homeowners Insurance Cover?

Homeowners insurance typically covers damage or loss caused by fire, theft, vandalism, and natural disasters such as hurricanes and tornadoes. It also covers personal belongings, such as furniture and electronics, and provides liability coverage in case someone is injured on your property.

However, it’s important to note that not all policies are the same. Some may offer additional coverage for things like water damage or identity theft, while others may have exclusions for certain types of damage. It’s important to review your policy and make sure you have the coverage you need.

Why Should I Get A New Insurance Quote?

Changes in Your Home

If you’ve made any changes to your home, such as renovations or additions, it’s important to get a new insurance quote. These changes can affect the value of your home and the amount of coverage you need. For example, if you’ve added a new room or upgraded your kitchen, your home’s value may have increased, and you may need more coverage to protect your investment.

Changes in Your Personal Situation

Life changes can also impact your homeowners insurance needs. If you’ve recently gotten married, had a child, or retired, your insurance needs may have changed. It’s important to review your policy and make sure you have the right coverage for your current situation.

Changes in the Insurance Market

The insurance market is constantly changing, and rates can fluctuate. By getting a new insurance quote, you can ensure that you are getting the best rate for your coverage. You may find that another insurance company is offering a better rate or that your current insurance company has lowered their rates.

Why Is Shopping My Policy Important?

One of the main reasons to shop your homeowners insurance policy is to save money. By getting quotes from multiple insurance companies, you can compare rates and find the best deal for your coverage. This can potentially save you hundreds of dollars each year.

The insurance market is constantly changing, and rates can fluctuate. By shopping your policy, you can stay up-to-date with the market and make sure you are getting the best rate for your coverage. This can also help you identify any gaps in your coverage and make necessary adjustments.

Who Can Help Me Shop My Policy?

One of the easiest ways to get homeowners insurance quotes in North Carolina is to contact an insurance agent. They can provide you with quotes from multiple insurance companies and help you find the best coverage for your needs.

There are several resources available to help you shop your homeowners insurance policy in North Carolina. These include:

- Insurance agents

- Online comparison tools

- State insurance department websites

It’s important to do your research and compare quotes from multiple sources to ensure you are getting the best deal for your coverage. Independent Insurance Agencies work with multiple carriers and can shop your policy for you to find the best rates and coverage.

How Can Homeowners in North Carolina Get A New Quote?

Shopping your homeowners insurance policy in North Carolina is important for several reasons. It can save you money, ensure you have adequate coverage, and keep you up-to-date with the insurance market. Don’t wait until it’s too late – review your policy and shop around today. To get started, contact the team at First Insurance Services. One of our expert North Carolina agents will walk you through the selection and comparison process, making sure you find a policy that’s fully customized for your specific situation. Together, we can find insurance that’ll give you peace of mind.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!