Pharmaceutical Insurance Quotes in North Carolina

First Insurance Services is proudly providing pharmaceutical insurance quotes to residents across North Carolina

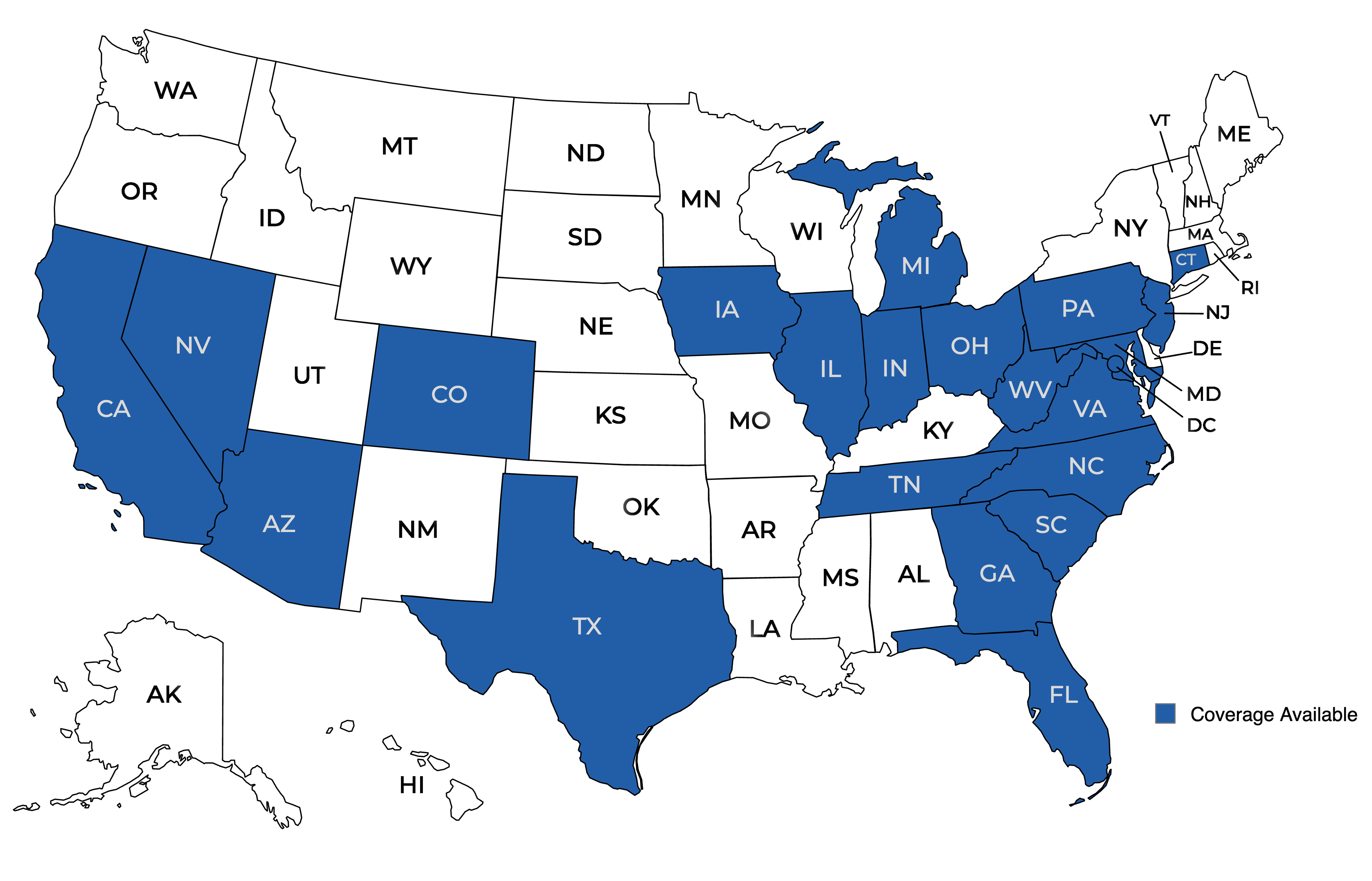

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Learn About Pharmaceutical Insurance Quotes in North Carolina

Pharmaceutical Insurance Quotes in North Carolina

Navigating the waters of insurance can be a complex process, especially when it pertains to a specialized field like pharmaceuticals. In North Carolina, pharmacists and pharmacy owners often find themselves seeking answers about how to protect their businesses and ensure they’re complying with state regulations. This article aims to provide clarity on frequently asked questions about pharmaceutical insurance quotes in the Tar Heel State.

What is Pharmaceutical Insurance?

Before we delve into specifics about North Carolina, let’s first understand what pharmaceutical insurance is and why it’s essential. Pharmaceutical insurance, also known as pharmacy or pharmacist insurance, is designed to provide coverage for risks and liabilities associated with the pharmaceutical industry. This can include coverage for property damage, professional liability, product liability, and other potential exposures that pharmacists and pharmacies face.

Why is Pharmaceutical Insurance Important?

Pharmacies dispense medications that can have significant effects on individuals’ health. Because of this high responsibility, there’s a considerable risk for errors, omissions, or adverse reactions that could lead to legal action. Pharmaceutical insurance helps protect pharmacists from the financial consequences of such claims.

What Types of Coverage Do North Carolina Pharmacists Need?

In North Carolina, pharmacists typically need several types of insurance:

- Professional Liability Insurance: This protects against claims of negligence or harm caused by professional services.

- General Liability Insurance: Covers non-professional liability issues, such as customer slips and falls.

- Product Liability Insurance: Provides protection if a product sold by the pharmacy causes harm.

- Property Insurance: Covers damage to the pharmacy building and its contents.

- Workers’ Compensation: Required if the pharmacy has employees, to cover injuries or illnesses that occur as a result of their job.

How Are Insurance Quotes Determined?

Insurance quotes are determined based on several factors, including the size of the pharmacy, its location, the volume of business, the types of services provided, and the insurance company’s assessment of the risk associated with insuring the pharmacy.

Where Can North Carolina Pharmacists Get Insurance Quotes?

Pharmacists can obtain insurance quotes from a variety of sources, including local insurance agents who specialize in business insurance, national insurers, and professional associations that offer insurance programs for their members.

An Independent Insurance Agent is a good option, as they don’t work for any one insurance company. They’ll shop your policy with multiple carriers to find the best coverage.

How Do I Get a Pharmaceutical Insurance Quote in North Carolina?

To get a pharmaceutical insurance quote in North Carolina, you will need to provide information about your pharmacy, such as its address, the services it offers, the number of employees, and details about the property. You can start by contacting an insurance broker or agent who will gather this information and provide you with quote options.

How Much Does Pharmaceutical Insurance Cost in North Carolina?

The cost of pharmaceutical insurance in North Carolina varies widely based on the factors mentioned above. It’s essential to get multiple quotes to ensure you’re getting a competitive rate for the coverage you need.

What Should I Look for in a Pharmaceutical Insurance Policy?

When evaluating a pharmaceutical insurance policy, consider the following:

- Coverage Limits: Ensure the policy provides enough coverage to protect your assets in case of a claim.

- Deductibles: Understand how much you will have to pay out of pocket before the insurance coverage kicks in.

- Exclusions: Be aware of what the policy does not cover. Some policies may exclude certain types of claims or incidents.

- Claims Service: Choose a provider with a good reputation for handling claims efficiently and fairly.

Are There Ways to Lower My Pharmaceutical Insurance Premiums?

Yes, there are several strategies to potentially lower your insurance premiums:

- Risk Management: Implementing safety protocols and training can reduce the likelihood of claims and may lower premiums.

- Bundling Policies: Some insurers offer discounts for bundling multiple types of coverage.

- Shop Around: Get quotes from several insurers to compare rates and coverage options.

Is Pharmaceutical Insurance Required by Law in North Carolina?

While professional liability insurance is not mandated by law in North Carolina, it is strongly recommended. Other types of insurance, such as property insurance, are not legally required but are prudent to have. Workers’ compensation is required if you have employees.

Tips for Choosing the Right Insurance Provider

Choosing the right insurance provider is crucial. Read on for tips to help you make an informed decision. Research potential insurers to ensure they have a solid reputation for customer service and claims handling. Look for reviews and testimonials from other pharmacists in North Carolina.

Don’t settle for the first quote you receive. Compare offerings from multiple insurers to find the best coverage at the most competitive price. Choose an insurer with experience in the pharmaceutical industry, as they’ll better understand the unique risks your business faces.

If you’re unsure about what type of coverage you need or how to evaluate quotes, consult with an insurance professional who can guide you through the process.

Conclusion

Pharmaceutical insurance is an essential consideration for pharmacists and pharmacy owners in North Carolina. By understanding the types of coverage required and how to obtain and evaluate quotes, you can ensure that you’re adequately protected against the risks inherent in the pharmaceutical industry.

Remember to review your insurance needs regularly and adjust your coverage as your business grows or changes. With the right insurance in place, you can focus on providing the best care and service to your customers, knowing that you’re protected against the unexpected.

In conclusion, obtaining the right pharmaceutical insurance quotes in North Carolina requires research, comparison, and a clear understanding of your business’s unique needs. By following the guidance provided in this FAQ, you can navigate the insurance landscape with confidence and secure the protection necessary for your pharmacy’s success.

How Can Pharmacists Get Pharmaceutical Insurance Quotes in North Carolina?

To begin the insurance process, get in touch with the independent agents at First Insurance Services. We’ll walk you through the selection and comparison process, making sure you find a policy that’s fully customized for your specific situation. Together, we can find insurance that’ll give you peace of mind.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!