Workers Compensation Insurance Quotes in North Carolina

First Insurance Services is proudly providing workers compensation insurance quotes to residents across North Carolina

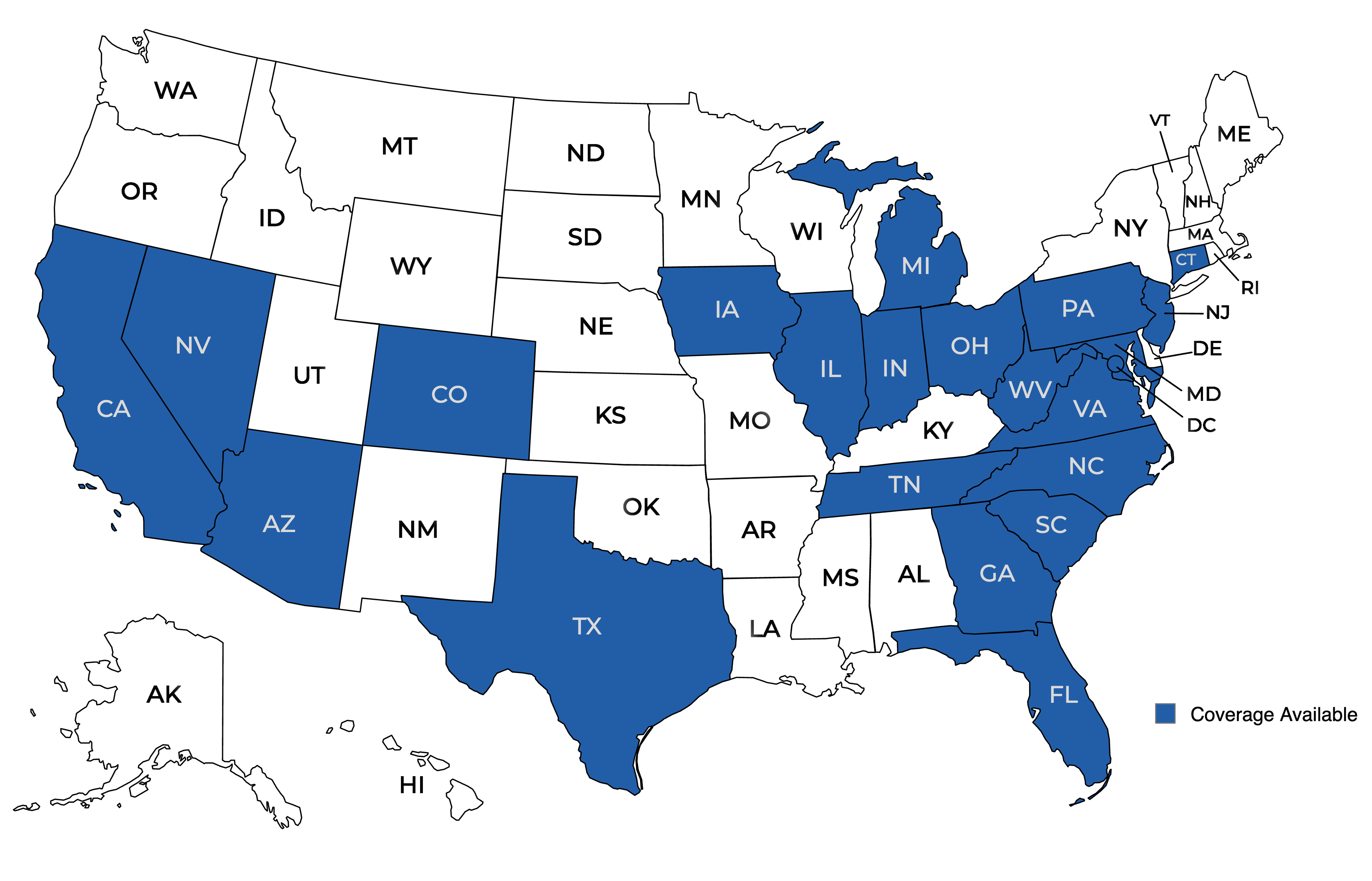

Providing insurance coverage to states across the nation.

Get a Quote

Send us your information for a free quote!

Learn About Workers Compensation Insurance Quotes in North Carolina

Workers Compensation Insurance Quotes in North Carolina

Navigating the world of workers compensation insurance can be complex. Especially when it comes to obtaining quotes. In North Carolina, like many states, workers comp insurance is a legal requirement. It’s crucial for protecting both employees and employers.

But how do you get accurate quotes? What factors influence the cost of your insurance?

This FAQ guide aims to answer these questions and more. It’s designed to help business owners and HR professionals understand the ins and outs of workers compensation insurance quotes.

Whether you’re new to the process or looking to better understand your current policy, this guide is for you. Let’s dive into the world of workers compensation insurance quotes.

What is Workers Compensation Insurance?

Workers compensation insurance is a type of business insurance. It’s designed to cover costs related to workplace injuries or illnesses.

When an employee gets hurt or sick because of their job, this insurance steps in. It can cover medical bills, lost wages, and even disability benefits.

For employers, workers comp insurance provides a layer of financial protection. It can help shield your business from costly lawsuits and out-of-pocket expenses.

In essence, workers compensation insurance is a vital safety net. It protects both your employees and your business.

Why Do Businesses in North Carolina Need Workers Comp?

In North Carolina, workers comp insurance is more than just a safety net. It’s a legal requirement for most businesses. If you employ three or more people, you’re required to have it. This rule applies whether your employees are full-time, part-time, or family members.

Without workers comp, you could face hefty fines. You might even be hit with a lawsuit if an employee gets injured. In short, workers comp insurance is essential. It’s a key part of doing business responsibly in North Carolina.

Legal Requirements for Workers Compensation in North Carolina

In North Carolina, the law is clear. If you have three or more employees, you must carry workers comp insurance. This rule applies to all businesses, regardless of industry. It doesn’t matter if your employees are full-time, part-time, or seasonal.

Failure to comply can result in severe penalties. These can include fines and even imprisonment. In short, workers comp isn’t optional in North Carolina. It’s a legal obligation for most businesses.

How to Obtain Workers Compensation Insurance Quotes

Getting workers compensation insurance quotes is a straightforward process. It starts with gathering the necessary information about your business.

This includes details like your industry, number of employees, and estimated payroll. You’ll also need to provide your business’s claims history.

Once you have this information, you can approach insurance providers. You can do this directly or through an insurance broker.

- Contact multiple providers for quotes

- Use online comparison tools

- Consult with an insurance broker

Remember, it’s important to compare quotes from different providers. This will help you find the best coverage at the most affordable price.

Factors Influencing Your Workers Comp Insurance Quote

Several factors can influence your workers comp insurance quote. Understanding these can help you manage your costs. The first factor is your industry and associated risk factors. High-risk industries like construction may have higher premiums.

Your company’s claims history also plays a role. A history of many claims can increase your premiums. The size of your business and your payroll estimates are also considered. Larger businesses with more employees usually have higher premiums.

Industry and Risk Factors

Different industries have different levels of risk. For example, a construction company has more workplace hazards than an office-based business.

These risk factors are reflected in your insurance premiums. Higher risk industries often have higher workers comp insurance costs.

Company’s Claims History and EMR

Your company’s claims history is another important factor. If your business has a history of many workers comp claims, your premiums may be higher. Your Experience Modification Rate (EMR) also affects your premiums. A lower EMR can result in lower premiums.

Business Size and Payroll Estimates

The size of your business and your payroll estimates also influence your insurance quote. Larger businesses with more employees usually have higher premiums.

Accurate payroll estimates are crucial. Underestimating can lead to increased costs later, while overestimating can result in overpaying.

Comparing Workers Compensation Quotes: What to Look For

When comparing workers compensation quotes, there are several key factors to consider. These can help you find the best coverage for your business. First, look at the coverage limits. Make sure they are sufficient for your business needs. Also, consider the insurance provider’s reputation. Check their customer reviews and financial stability.

Here are some key points to consider:

- Coverage limits

- Provider’s reputation

- Cost of premiums

- Policy exclusions

- Customer service

Remember, the cheapest quote may not always be the best. It’s important to balance cost with coverage and service.

Reducing Workers Compensation Insurance Costs

Reducing your workers compensation insurance costs is possible. It requires a proactive approach to safety and risk management. Implementing a safety program can lower your premiums. It shows insurers that you are committed to preventing workplace accidents.

Here are some strategies to reduce costs:

- Implement a safety program

- Train employees on safety procedures

- Regularly review and update safety measures

- Promptly address any safety concerns

Remember, a safe workplace not only reduces insurance costs but also protects your employees. It’s a win-win situation for everyone.

Common Questions About Workers Comp Claims

Workers comp claims can be complex. It’s common to have questions about the process.

Here are some frequently asked questions:

- What types of injuries are covered?

- How do I file a claim?

- What happens after a claim is filed?

- Can a claim be denied?

Understanding the claims process can help you navigate it more efficiently. It’s important to promptly report any workplace injuries to ensure a smooth claims process. Remember, each state has its own rules for workers comp claims. Be sure to understand the specific requirements in North Carolina.

Final Tips Before Choosing Your Workers Comp Policy

Before you finalize your workers comp policy, take time to review all details. Understand the coverage limits and any potential exclusions. Consult with an insurance professional if needed. They can help you navigate the fine print and ensure you’re making an informed decision.

Remember, staying informed about changes in workers compensation laws and regulations is crucial. It helps you maintain compliance and manage costs effectively.

How Can Businesses in North Carolina Get Workers Compensation Insurance?

Securing Workers Compensation Insurance in North Carolina is not just a legal obligation but a commitment to the well-being of your workforce. Obtaining quotes, reviewing policies, and staying proactive are essential steps in this process. By leveraging the services of an independent insurance agent like First Insurance Services, you ensure that your coverage aligns with the dynamic nature of the business environment in North Carolina.

Contact First Insurance Services to get your personalized Workers Compensation Insurance quote today. Safeguard your business and protect your employees – because a secure future starts with the right insurance coverage.

Working hours

Open | Mon-Fri 8 am-4:30 pm

Our location

5007 Southpark Dr., Ste 230

Durham, NC 27713

Contact us

Contact us!

Contact the First Insurance Services team today for any questions or to receive an insurance quote!